Your credit score plays a huge role in getting preapproved and how high your interest rate will be. Here are 3 hidden ways to improve your credit score!

3 Reasons To Use A Local Lender! Purchasing a home is stressful enough searching for your dream home, negotiating repairs and packing and moving. The last thing you want to worry about is if your lender is going to change your fees or rescind your approval. Choosing a local lender will give you the best shot at closing on your home.

There are many reasons you may not be able to qualify for a mortgage but here are the top 3!

There is more costs associated with buying a home than just your down payment! You also need to budget in your closing costs and prepaids. Here is a video that breaks down common closing cost fees.

In 2020, 43% of households in the US paid more that 30% of their income towards housing. 14% paid over 50%!

When buying a house it is important to budget your future payments to ensure you aren't living HOUSE POOR!

The average home owner's net worth is 40% higher that someone who rents.

Want more wealth in your future?

The average home owner's net worth is 40% higher that someone who rents. Want more wealth in your future? Check out the video to learn about three ways home ownership will increase your wealth!

As we approach the end of 2022, many people are starting to think about their next big life decision: buying a home. If you're considering making the leap into homeownership, there are a few reasons why 2023 could be the perfect time for you to buy, and if you are in the Topeka Kansas area, we'd love to help as your trusted Realtors®!

-

Interest rates are expected to remain affordable.

One of the biggest factors that can impact the cost of a mortgage is the interest rate. Interest rates have been at historic lows in recent years, and experts predict that they will remain affordable in 2023.

In an effort to stimulate the economy during the pandemic it was common to find mortgage rates in the 3% range. If you haven't been paying attention, rates have now creeped into the mid 6% range. What you may not know is the average mortgage rate over the past 30 years is 7.7%!

While there may be a few more rate increases at the beginning of 2023, many economists are predicting the rates to continue to hang in the 6%-7% range throughout the year and possibly dip abck into the upper 5% range towards as we approach 2024.

In 2023 you'll still be able to secure a mortgage with a lower than average interest rate, which can save you thousands of dollars over the life of your loan.

-

There may be more inventory on the market.

In the past few years, the demand for housing has outweighed the supply in many areas, leading to a seller's market. This has made it difficult for buyers to find the right home at a price they can afford and when they found it, they had to compete with many other buyers and get into a bidding war just to try and buy a home that fit their needs. However, it's possible that we'll see more homes hit the market in 2023, which could give buyers more options and level prices out.

Many experts believe that we should see more homes hit the market as the economy continues to recover from the pandemic. As people's financial situations improve, they may be more likely to consider buying a home and may decide to sell their current home in order to do so.

-

Home prices may continue to rise.

While it's impossible to predict the future with 100% accuracy, it's likely that home prices will continue to rise in the coming years. While we don't anticipate 10-15% appreciation as we've seen in 2020-2021, here in Topeka Kansas, prices will most likely near plateau with the typical 3% appreciation rate we are accustomed to.

While it's impossible to predict the future with 100% accuracy, it's likely that home prices will continue to rise in the coming years. While we don't anticipate 10-15% appreciation as we've seen in 2020-2021, here in Topeka Kansas, prices will most likely near plateau with the typical 3% appreciation rate we are accustomed to.

Similar to the the "The best time to plant a tree..." proverb, the best time to buy a house was 20 years ago, the second best time is now! If you wait to buy, you may end up paying more for a home than you would if you bought now. By buying in 2023, you'll be able to lock in a lower price and potentially see your home appreciate in value over time.

-

You may be able to take advantage of first-time homebuyer programs.

There are a number of programs available to help first-time homebuyers get their foot in the door. These programs can provide assistance with down payments, closing costs, and other expenses associated with buying a home. By taking advantage of these programs in 2023, you may be able to afford a home that you wouldn't have been able to otherwise.

Conclusion

2023 could be a great time to buy a home for a number of reasons. From affordable interest rates to potential increases in inventory and home prices, there are plenty of factors that could make now the right time for you to make the leap into homeownership. If you're considering buying a home, it's worth exploring your options and consulting with your favorite Team Ringgold Realtor® and your lender* to make a plan to get you in the new home you've been dreaming about in 2023.

*Don't have a lender yet, we can certainly make a recommendation!

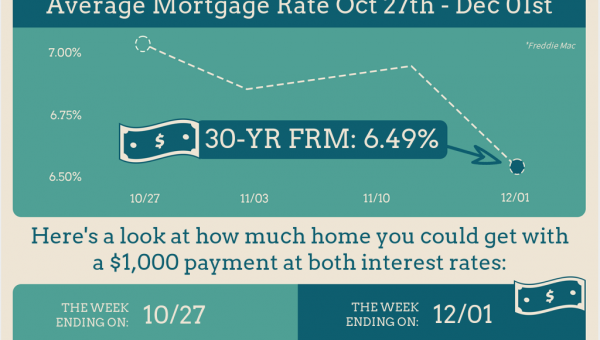

The recent drop in rates could mean big savings for you if you’re considering buying!

Take a look at how much buying power you have with each of the rates, and how much interest you’ll save over 10 years, by securing this new-and-improved rate!

At the current rates, a $1000 per month payment gives you the buying power to purchase approximately a $125,000 home!