What is Equity?

Per Merriam-Webster, Equity is the money value of a property or of an interest in a property in excess of claims or liens against it. Exactly as this definition states it is the value of the property minus any expenses. So if you have a $150,000 property and you have a $100,000 mortgage on your property then you have $50,000 in equity. This isn’t quite like having $50,000 in your bank but it’s fairly close to the same.

When I look at investment opportunities my number one priority is equity. Equity can be used over and over again to further your real estate investing journey. There are a couple different ways you can come about equity in an investment.

Finding Equity

A wise man once said that you make money with the purchase of an investment, not the sale of an investment. This is true. The best way to build equity in your real estate portfolio is to buy at a discount, but how do you know if you're buying at a discount.

As previously discussed in my last article we have to start with comparable sales in the area. Pick homes that are in the same neighborhood and the same condition as your subject property. If all the homes around are selling for $150,000 you know that this home should be valued at $150,000. Now you have to find a way to buy it for less than market value to build instant equity in the deal. Finding an “off market” property is the best way to do this.

This can be tricky at times. You really have to look for a distressed seller. Someone who needs to sell the property quickly and with as least amount of hassle as possible. For example this could be someone that has to move quickly due to a job relocation, or someone who is going through a divorce or a foreclosure. In these situations the seller may not want to go through the hassle of listing the property, have it sit on the market, and paying Realtor fees. If they can sell to you without making any repairs or spending any time or money, they may see that as a higher value to them than additional money.

In negotiating a price lower than market value, you may need to extend closing and possession for them. If they sell on the open market, this will take time and this means they are paying additional taxes, utilities, and mortgage payments than they would if they sell it to you now. They will also most likely have to pay Realtor fees and possibly closing costs and repairs for any other buyer. If you add all the holding costs and other fees up, this could reach 15-20% pretty easily. So selling to you for a 20-25% discount could net them the same amount of money in less time. This is how you could buy a $150,000 home for $120,000. This is how you buy equity in the purchase of your next investment property.

Building Equity

Finding a distressed property is the easiest way to build equity into a property. This is a property that will need some work done to bring it up to the same standard as the other homes in the area. Be careful though, in this same $150,000 neighborhood you may find a distressed property, however if the property is in a poorer condition than the other houses in the area and you buy it at $120,000 you are not buying with equity in the deal because you may have to spend $30,000 to bring it up to the $150,000 mark. Meaning you would still have $150,000 in the property which will equal you $0 in equity.

To build equity into a deal like this you have to make a detailed list of what the property needs to bring the value up to $150,000 and be sure the cost of the property plus the cost of the repairs is less that the value of the updated property. Look for homes that need cosmetic repairs such as; old carpet, outdated kitchens, peeling paint, broken fences. These cosmetic issues can seem like a huge expense to the seller, but for you, you may be able to find a contractor to do the workor maybe you do the work yourself for a fraction of what the seller thinks it will cost them.

So a property in poor condition could have an actual market value of 75-80% of the other nice houses in the area and this could be your starting point. You can buy it at this reduced value as long as you keep the cost of rehabbing the property under 20-25% of the value. Let's say you purchase the property at market value for $120,000. You go in and you replace the carpet with LVP flooring, you paint the cabinets, paint all the walls in a neutral color, and clean up the yard. Maybe you can get all this done for $10,000. You have just built $20,000 of equity in this deal. You have $130,000 invested and now this property is worth $150,000. You just made $20,000 in the short time it took you to rehab the property.

Congratulations! Now let’s talk about long term equity growth.

Long Term Equity Growth

One of the great aspects of real estate investing is the reliability of appreciation. , According to the FHFA, Since 1991, the average annual home price increase has been 4.3%. Some times this annual appreciation can be less and sometimes it can be more. Between April 2021 and April 2022, home values nationally rose 18.8%! That means if you bought a home in April of 2021 for $100,000 you gained $18,800 of equity in just 12 months! Holding real estate long term is how you take advantage of appreciation. If you look at the $100,000 property you bought in April of 2021 that rose 18.8% in 12 months, if you held on to that property for another 12 months then you could possibly gain another 10% equity. Bringing your total equity to possibly $28,800 in just 24 months. Yes, the last couple years has been unprecedented but you get the idea.

Now lets compound this with finding a distressed seller of a distressed property. The $120,000 property happens to be in poor condition and was in a $150,000 neighborhood. You put $10,000 of repairs into. You gained $20,000 buy finding and building equity into the deal and your $150,000 home has gained 28.8% equity in 2 years. That property is now worth $193,200 and you have $130,000 invested. That is a total of $63,200 in equity in just 2 years.

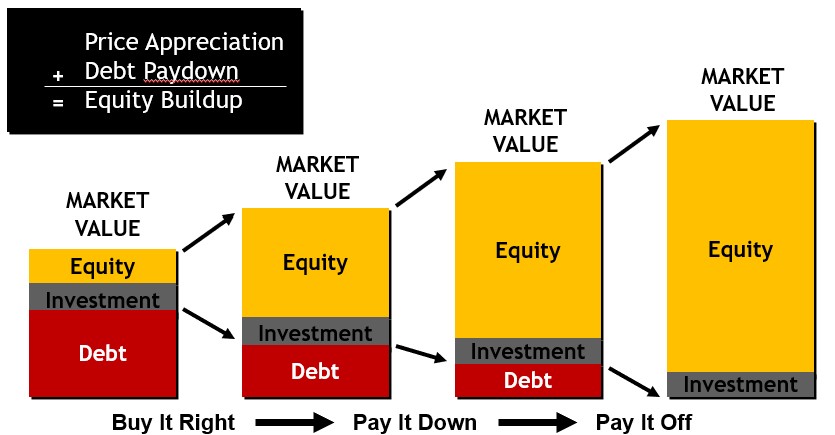

Up to this point we have just been talking about purchasing and holding property. But lets face it, you aren’t investing in real estate to hold the asset and just let it sit there to grow. You are going to be renting this property and more than likely you are going to have a mortgage on this property. Take a look at the graphic below.

Here you can see the first box is quite small. This is our $120,000 property we “bought right” at a discount. The equity is the $20,000 you found and built into the property when you bought at a discount and rehabbed the property. The investment is the $10,000 you used to repair the property plus the down payment and closing costs you paid to finance the deal, and the debt portion is your mortgage on the property.

As you can see, as time progressees, your market value increases as does appreciation over time. The investment portion is the same amount but the debt portion has decreased and your equity has increase. When your tenant pays rent and you then pay the mortgage, the rent money is actively paying down your principle debt on the property. This turns into equity. So on and so forth.

Putting It All Together

If you can buy a distressed property from a distressed seller, build some equity into the property and rent that property so that a tenant pays off your debt, you can see how your equity in a property can grow exponentially over time. One key point I hadn’t outlined in this article is if you used someone else’s money to build this equity. With a mortgage, you only have to put a little amount of money into the deal that will eventually pay for itself and then some.

.png)