Topeka, KS, one of the real estate market areas served by members of the Sunflower Association of REALTORS®, Inc. was ranked No. 7 on the Summer 2023 Emerging Housing Markets Index issued jointly today by The Wall Street Journal and Realtor.com®. This is the 2nd time that Topeka has been on the WSJ “emerging market” list in 2023 and the 4th time since October of 2021.

According to information published by The Wall St. Journal and Realtor.com®, “the Index analyzes key housing market data, as well as economic vitality and lifestyle metrics, to surface emerging housing markets that offer a high quality of life and are expected to see future home price appreciation.” Joining Topeka on The Top 10 Emerging Housing Markets for summer 2023 are:

1. Lafayette-West Lafayette, Ind.

2. Fort Wayne, Ind.

3. Elkhart-Goshen, Ind.

4. Bloomington, Ill.

5. Sioux City, Iowa-Neb.-S.D.

6. Columbus, Ohio

7. Topeka, Kan.

8. Johnson City, Tenn.

9. South Bend-Mishawaka, Ind.

10. Kingsport-Bristol-Bristol, Tenn.-Va.

The analysis highlighted the following key trends shared among markets on the list.

Emerging markets offer lower cost of living - Home prices have begun to ease nationally, falling 0.9% in June. However, the cost of purchasing a home continues to strain many buyers. Similar to previous quarters, Summer 2023’s emerging markets continue to lean heavily on affordability. Home list prices in all but four of the top 20 markets are lower than the median-priced U.S. home for sale, which was $445,000 in June.

- Sustained demand drives high price growth, quick market pace - The median price of the typical home for sale is just slightly lower than last June. While the national market has slowed, this quarter’s emerging markets have continued to attract attention due to their affordability and desirability, which has kept price growth strong. The average increase in listing price was 25% among the top 20 markets compared to 8.9% nationally for the 12 months ending in June 2023.

- Mid-sized markets with strong employment and convenient commutes – The job market has remained near recent unemployment lows, notching 3.6% unemployment in June. Remarkably, the emerging markets have even better employment trends, with an average unemployment rate of just 2.9% in May. Only three of the top 20 markets had an unemployment rate above the 300-market average (3.5%).

- Affordability attracts out-of-market shoppers - The real estate markets on this list tend to be smaller, more affordable destinations in the Midwest with strong job markets. Those lower prices have proven to be a strong draw for out-of-towners.

According to the jointly issued report, the index methodology looks at:

The ranking evaluates the 300 most populous core-based statistical areas, as measured by the U.S. Census Bureau, and defined by March 2020 delineation standards for eight indicators across two broad categories: real estate market (50%) and economic health and quality of life (50%). Each market is ranked on a scale of 0 to 100 according to the category indicators, and the overall index is based on the weighted sum of these rankings. The real estate market category indicators are: real estate demand (16.6%), based on average pageviews per property; real estate supply (16.6%), based on median days on market for real estate listings, median listing price trend (16.6%). The economic and quality of life category indicators are: unemployment (6.25%); wages (6.251%); regional price parities (6.25%); the share of foreign born (6.25%); small businesses (6.25%); amenities (6.25%), measured as the average number of stores per specific “everyday splurge” category (coffee, upscale/specialty grocery, home improvement, fitness) per capita in an area; commute (6.25%); and estimated effective real estate taxes (6.25%).

Release issued by WSJ-Realtor.com: https://www.dowjones.com/press-room/the-wall-street-journaland-realtor-com-release-summer-2023-emerging-housing-markets-index-report/

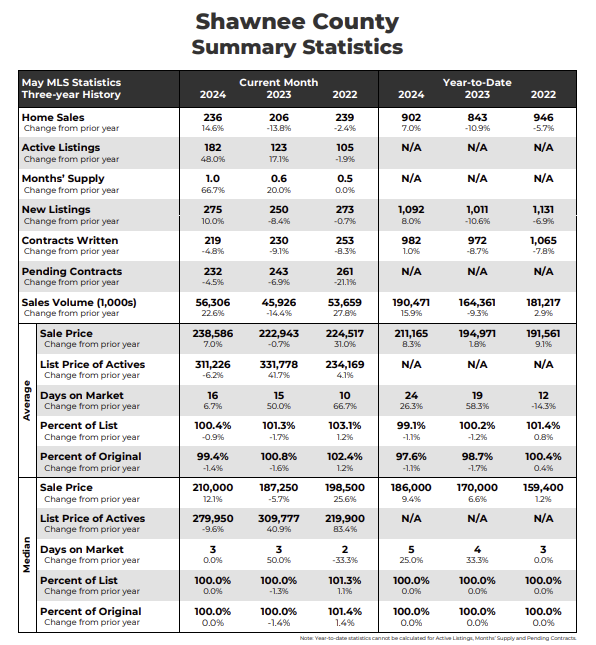

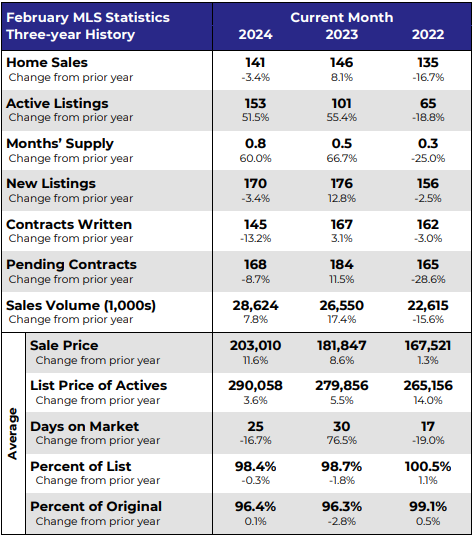

Shawnee County Home Sales Fell in February

Shawnee County Home Sales Fell in February

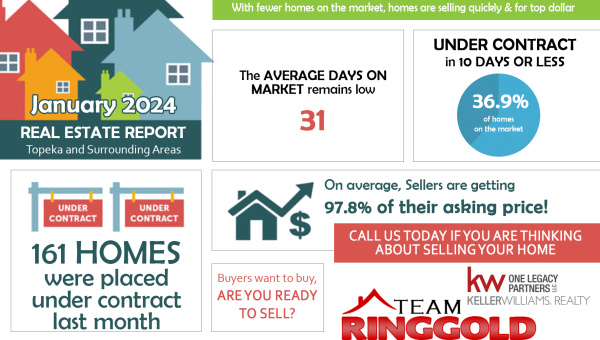

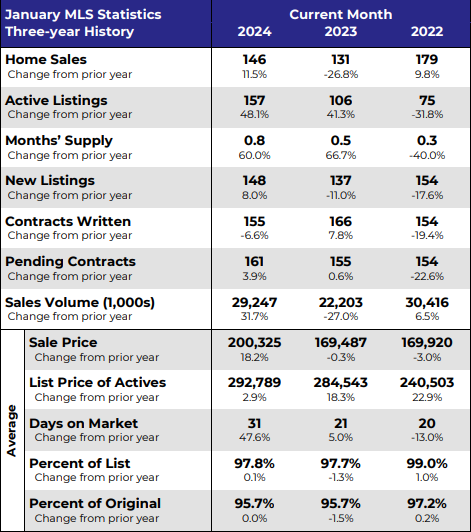

Shawnee County Home Sales Rose in January

Shawnee County Home Sales Rose in January

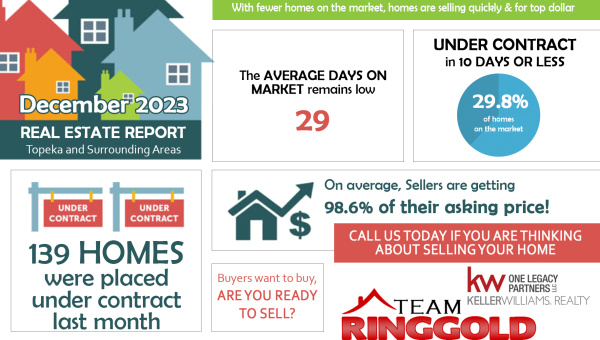

Shawnee County Home Sales Rose in December

Shawnee County Home Sales Rose in December

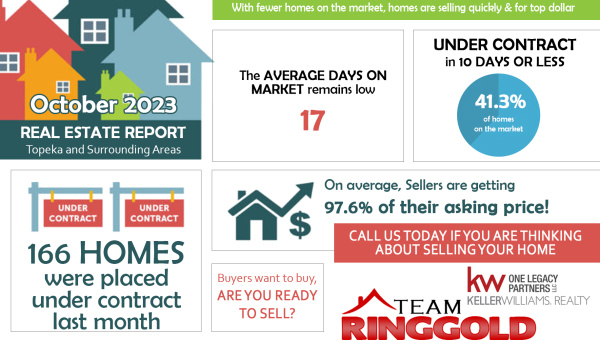

Shawnee County Home Sales Fell in October

Shawnee County Home Sales Fell in October

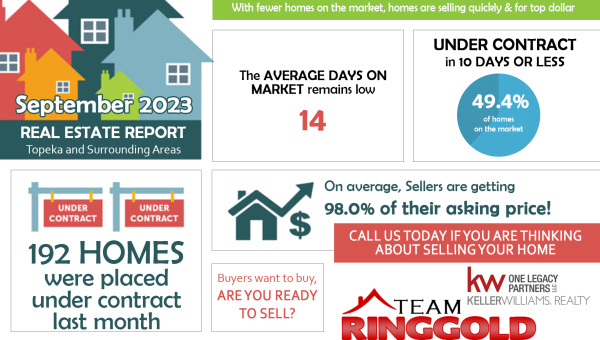

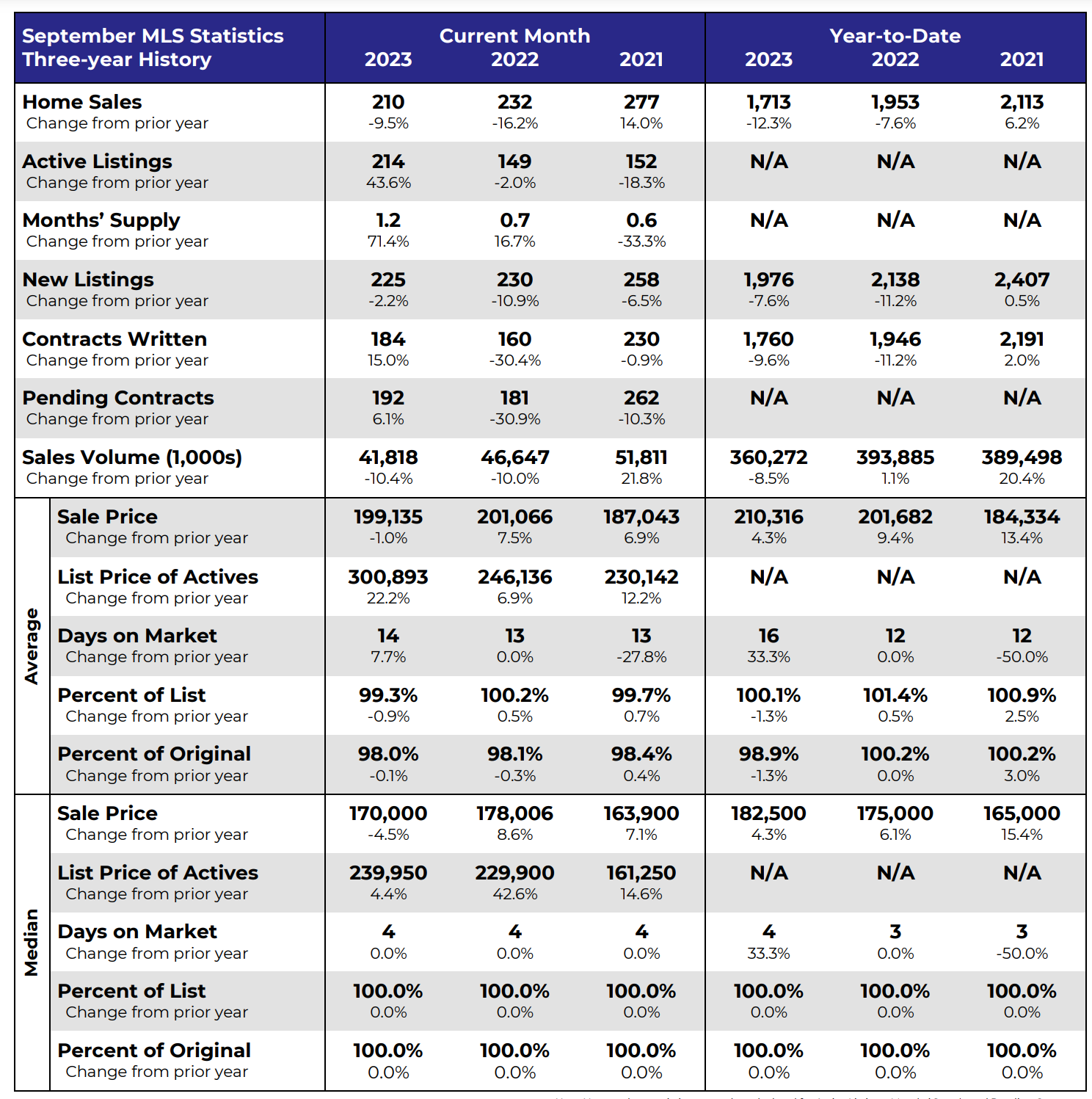

Shawnee County Home Sales Fell in September

Shawnee County Home Sales Fell in September

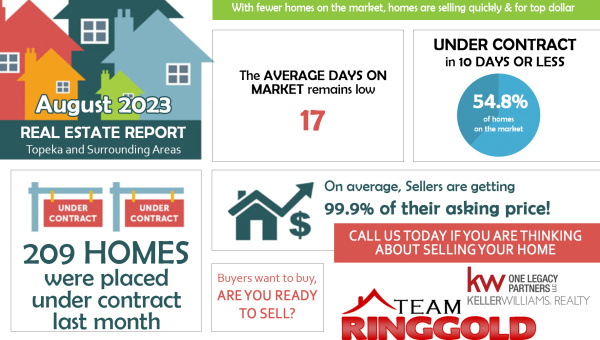

Shawnee County Home Sales Fell in August

Shawnee County Home Sales Fell in August

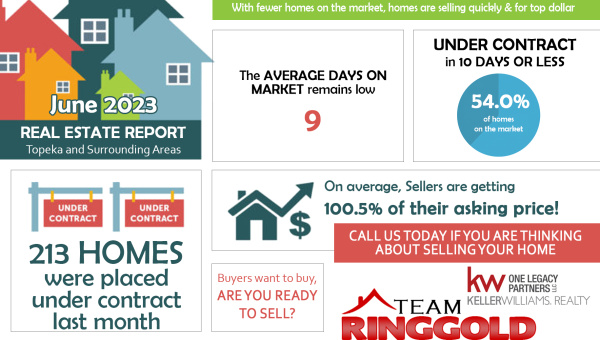

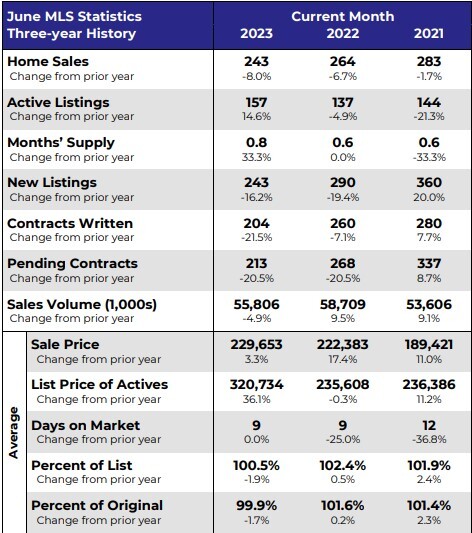

Total home sales in Shawnee County fell last month to 243 units, compared to 264 units in June 2022. Total sales volume was $55.8 million, down from a year earlier.

Total home sales in Shawnee County fell last month to 243 units, compared to 264 units in June 2022. Total sales volume was $55.8 million, down from a year earlier.