Shawnee County Home Sales Fell in May

Shawnee County Home Sales Fell in May

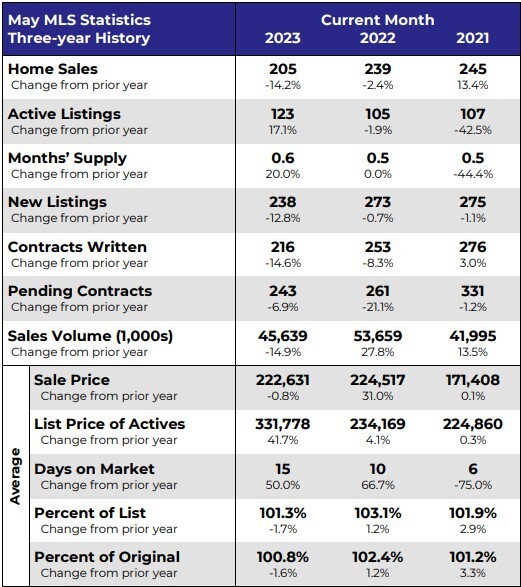

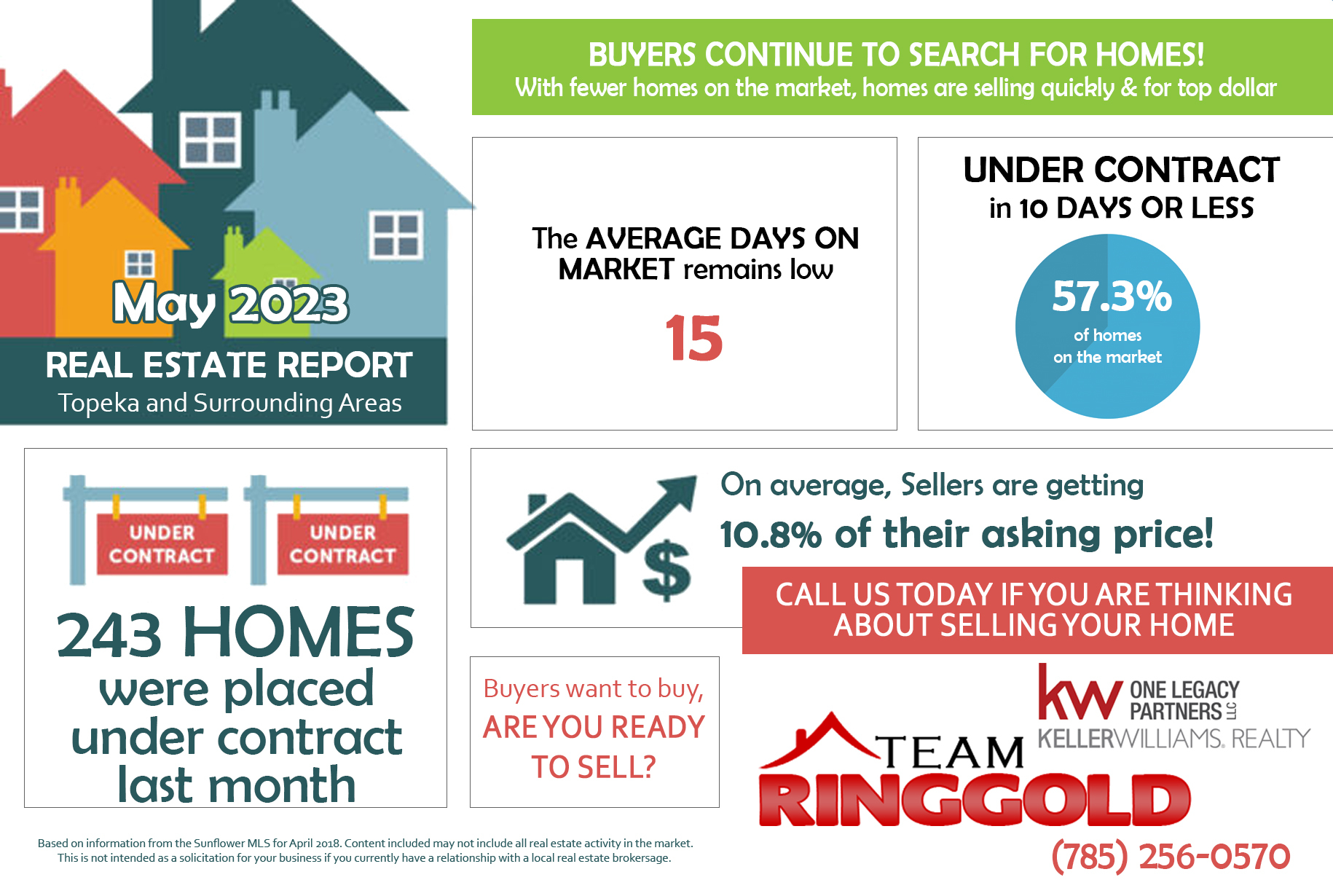

Total home sales in Shawnee County fell last month to 205 units, compared to 239 units in May 2022. Total sales volume was $45.6 million, down from a year earlier.

The median sale price in May was $187,000, down from $198,500 a year earlier. Homes that sold in May were typically on the market for 3 days and sold for 100.0% of their list prices.

Shawnee County Active Listings Up at End of May

The total number of active listings in Shawnee County at the end of May was 123 units, up from 105 at the same point in 2022. This represents a 0.6 months' supply of homes available for sale.

The median list price of homes on the market at the end of May was $309,777. During May, a total of 216 contracts were written down from 253 in May 2022. At the end of the month, there were 243 contracts still pending.

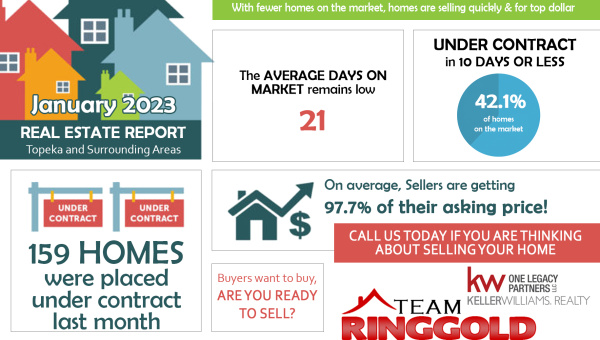

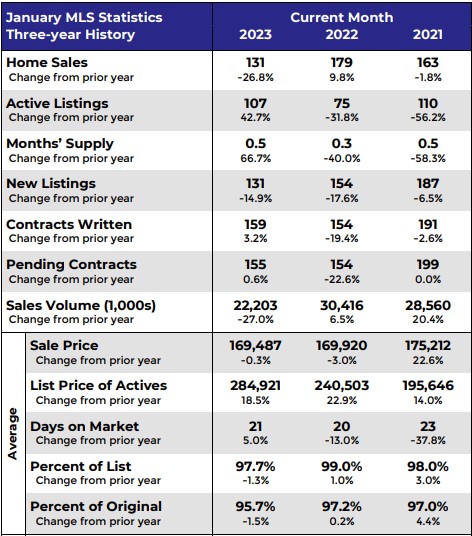

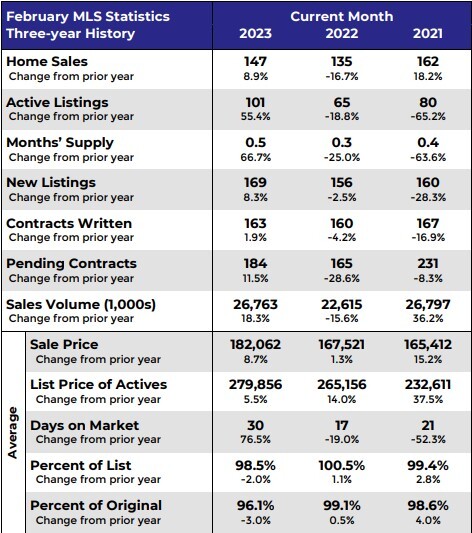

Shawnee County Home Sales Rose in February

Shawnee County Home Sales Rose in February